linear models view markdown

Material from "Statistical Models Theory and Practice" - David Freedman

introduction

-

$Y = X \beta + \epsilon$

type of linear regression X Y simple univariate univariate multiple multivariate univariate multivariate either multivariate generalized either error not normal -

minimize: $L(\theta) = ||Y-X\beta||_2^2 \implies \hat{\theta} = (X^TX)^{-1} X^TY$

-

2 proofs

- set deriv and solve

- use projection matrix H to show HY is proj of Y onto R(X)

- the projection matrix maps the responses to the predictions: $\hat{y} = Hy$

- define projection (hat) matrix $H = X(X^TX)^{-1} X^T$

- show $||Y-X \theta||^2 \geq ||Y - HY||^2$

- key idea: subtract and add $HY$

- interpretation

- if feature correlated, weights aren’t stable / can’t be interpreted

- curvature inverse $(X^TX)^{-1}$ - dictates stability

- feature importance = weight * feature value

- LS doesn’t work when p » n because of colinearity of X columns

- assumptions

- $\epsilon \sim N(X\beta,\sigma^2)$

- homoscedasticity: $\text{var}(Y_i|X)$ is the same for all i

- opposite is heteroscedasticity

- normal linear regression

- variance MLE $\hat{\sigma}^2 = \sum (y_i - \hat{\theta}^T x_i)^2 / n$

- in unbiased estimator, we divide by n-p

- LS has a distr. $N(\theta, \sigma^2(X^TX)^{-1})$

- variance MLE $\hat{\sigma}^2 = \sum (y_i - \hat{\theta}^T x_i)^2 / n$

- linear regression model

- when n is large, LS estimator ahs approx normal distr provided that X^TX /n is approx. PSD

- weighted LS: minimize $\sum [w_i (y_i - x_i^T \theta)]^2$

- $\hat{\theta} = (X^TWX)^{-1} X^T W Y$

- heteroscedastic normal lin reg model: erorrs ~ N(0, 1/w_i)

- leverage scores - measure how much each $x_i$ influences the LS fit

- for data point i, $H_{ii}$ is the leverage score

- LAD (least absolute deviation) fit

- MLE estimator when error is Laplacian

freedman notes

regularization

- when $(X^T X)$ isn’t invertible can’t use normal equations and gradient descent is likely unstable

- X is nxp, usually n » p and X almost always has rank p

- problems when n < p

- intuitive way to fix this problem is to reduce p by getting rid of features

- a lot of papers assume your data is already zero-centered

- conventionally don’t regularize the intercept term

- ridge regression (L2)

- if $X^T X$ is not invertible, add a small element to diagonal

- then it becomes invertible

- small lambda -> numerical solution is unstable

- proof of why it’s invertible is difficult

- argmin $\sum_i (y_i - \hat{y_i})^2+ \lambda \vert \vert \beta\vert \vert _2^2 $

- equivalent to minimizing $\sum_i (y_i - \hat{y_i})^2$ s.t. $\sum_j \beta_j^2 \leq t$

- solution is $\hat{\beta_\lambda} = (X^TX+\lambda I)^{-1} X^T y$

- for small $\lambda$ numerical solution is unstable

- When $X^TX=I$, $\beta {Ridge} = \frac{1}{1+\lambda} \beta{Least Squares}$

- lasso regression (L1)

- $\sum_i (y_i - \hat{y_i})^2+\lambda \vert \vert \beta\vert \vert _1 $

- equivalent to minimizing $\sum_i (y_i - \hat{y_i})^2$ s.t. $\sum_j \vert \beta_j\vert \leq t$

- lasso - least absolute shrinkage and selection operator - L1

- acts in a nonlinear manner on the outcome y

- keep the same SSE loss function, but add constraint of L1 norm

- doesn’t have closed form for Beta

- because of the absolute value, gradient doesn’t exist

- can use directional derivatives

- good solver is LARS - least angle regression - if tuning parameter is chosen well, will set lots of coordinates to 0 - convex functions / convex sets (like circle) are easier to solve - disadvantages

- if p>n, lasso selects at most n variables

- if pairwise correlations are very high, lasso only selects one variable

- elastic net - hybrid of the other two

- $\beta_{Naive ENet} = \sum_i (y_i - \hat{y_i})^2+\lambda_1 \vert \vert \beta\vert \vert _1 + \lambda_2 \vert \vert \beta\vert \vert _2^2$

- l1 part generates sparse model

- l2 part encourages grouping effect, stabilizes l1 regularization path

- grouping effect - group of highly correlated features should all be selected - naive elastic net has too much shrinkage so we scale $\beta_{ENet} = (1+\lambda_2) \beta_{NaiveENet}$ - to solve, fix l2 and solve lasso

the regression line (freedman ch 2)

- regression line

- goes through $(\bar{x}, \bar{y})$

- slope: $r s_y / s_x$

- intercept: $\bar{y} - slope \cdot \bar{x}$

- basically fits graph of averages (minimizes MSE)

- SD line

- same except slope: $sign(r) s_y / s_x$

- intercept changes accordingly

- for regression, MSE = $(1-r^2) Var(Y)$

multiple regression (freedman ch 4)

- assumptions

- assume $n > p$ and X has full rank (rank p - columns are linearly independent)

- $\epsilon_i$ are iid, mean 0, variance $\sigma^2$

- $\epsilon$ independent of $X$

- $e_i$ still orthogonal to $X$

-

OLS is conditionally unbiased

- $E[\hat{\theta} | X] = \theta$

- $Cov(\hat{\theta}|X) = \sigma^2 (X^TX)^{-1}$

- $\hat{\sigma^2} = \frac{1}{n-p} \sum_i e_i^2$

- this is unbiased - just dividing by n is too small since we have minimized $e_i$ so their variance is lower than var of $\epsilon_i$

- $\hat{\sigma^2} = \frac{1}{n-p} \sum_i e_i^2$

- random errors $\epsilon$

- residuals $e$

- $H = X(X^TX)^{-1} X^T$

- e = (I-H)Y = $(I-H) \epsilon$

- H is symmetric

- $H^2 = H, (I-H)^2 = I-H$

- HX = X

- $e \perp X$

- basically H projects Y int R(X)

- $E[\hat{\sigma^2}|X] = \sigma^2$

- random errs don’t need to be normal

- variance

- $var(Y) = var(X \hat{\theta}) + var(e)$

- $var(X \hat{\theta})$ is the explained variance

- fraction of variance explained: $R^2 = var(X \hat{\theta}) / var(Y)$

- like summing squares by projecting

- if there is no intercept in a regression eq, $R^2 = ||\hat{Y}||^2 / ||Y||^2$

- $var(Y) = var(X \hat{\theta}) + var(e)$

advanced topics

BLUE

- drop assumption: $\epsilon$ independent of $X$

- instead: $E[\epsilon|X]=0, cov[\epsilon|X] = \sigma^2 I$

- can rewrite: $E[\epsilon]=0, cov[\epsilon] = \sigma^2 I$ fixing X

- Gauss-markov thm - assume linear model and assumption above: when X is fixed, OLS estimator is BLUE = best linear unbiased estimator

- has smallest variance.

- prove this

GLS = GLM

- GLMs roughly solve the problem where outcomes are non-Gaussian

- mean is related to $w^tx$ through a link function (ex. logistic reg assumes sigmoid)

- also assume different prob distr on Y (ex. logistic reg assumes Bernoulli)

- generalized least squares regression model: instead of above assumption, use $E[\epsilon|X]=0, cov[\epsilon|X] = G, : G \in S^K_{++}$

- covariance formula changes: $cov(\hat{\theta}_{OLS}|X) = (X^TX)^{-1} X^TGX(X^TX)^{-1}$

- estimator is the same, but is no longer BLUE - can correct for this: $(G^{-1/2}Y) = (G^{-1/2}X)\theta + (G^{-1/2}\epsilon)$

- feasible GLS=Aitken estimator - use $\hat{G}$

- examples

- simple

- iteratively reweighted

- 3 assumptions can break down:

- if $E[\epsilon|X] \neq 0$ - GLS estimator is biased

- else if $cov(\epsilon|X) \neq G$ - GLS unbiased, but covariance formula breaks down

- if G from data, but violates estimation procedure, estimator will be misealding estimate of cov

path models

- path model - graphical way to represent a regression equation

- making causal inferences by regression requires a response schedule

simultaneous equations

- simultaneous-equation models - use instrumental variables / two-stage least squares

- these techniques avoid simultaneity bias = endogeneity bias

binary variables

- indicator variables take on the value 0 or 1

- dummy coding - matrix is singular so we drop the last indicator variable - called reference class / baseline class

- effect coding

- one vector is all -1s

- B_0 should be weighted average of the class averages

- orthogonal coding

- additive effects assume that each predictor’s effect on the response does not depend on the value of the other predictor (as long as the other one was fixed

- assume they have the same slope

- interaction effects allow the effect of one predictor on the response to depend on the values of other predictors.

- $y_i = β_0 + β_1x_{i1} + β_2x_{i2} + β_3x_{i1}x_{i2} + ε_i$

LR with non-linear basis functions

- can have nonlinear basis functions (ex. polynomial regression)

- radial basis function - ex. kernel function (Gaussian RBF)

- $\exp(-(x-r)^2 / (2 \lambda ^2))$

- non-parametric algorithm - don’t get any parameters theta; must keep data

locally weighted LR (lowess)

- recompute model for each target point

- instead of minimizing SSE, we minimize SSE weighted by each observation’s closeness to the sample we want to query

kernel regression

-

nonparametric method

-

$\operatorname{E}(Y X=x) = \int y f(y x) dy = \int y \frac{f(x,y)}{f(x)} dy$ Using the kernel density estimation for the joint distribution ‘‘f(x,y)’’ and ‘‘f(x)’’ with a kernel ‘’’'’K’’’’’,

$\hat{f}(x,y) = \frac{1}{n}\sum_{i=1}^{n} K_h\left(x-x_i\right) K_h\left(y-y_i\right)$ $\hat{f}(x) = \frac{1}{n} \sum_{i=1}^{n} K_h\left(x-x_i\right)$

we get

$\begin{align} \operatorname{\hat E}(Y X=x) &= \int \frac{y \sum_{i=1}^{n} K_h\left(x-x_i\right) K_h\left(y-y_i\right)}{\sum_{j=1}^{n} K_h\left(x-x_j\right)} dy,\ &= \frac{\sum_{i=1}^{n} K_h\left(x-x_i\right) \int y \, K_h\left(y-y_i\right) dy}{\sum_{j=1}^{n} K_h\left(x-x_j\right)},\ &= \frac{\sum_{i=1}^{n} K_h\left(x-x_i\right) y_i}{\sum_{j=1}^{n} K_h\left(x-x_j\right)},\end{align}$

GAM = generalized additive model

- generalized additive models: assume mean output is sum of functions of individual variables (no interactions)

- learn individual functions using splines

- $g(\mu) = b + f(x_0) + f(x_1) + f(x_2) + …$

- can also add some interaction terms (e.g. $f(x_0, x_1)$)

multicollinearity

- multicollinearity - predictors highly correlated

- this affects fitted coefficients, potentially changing their values and even flipping their sign

- variance inflation factor (VIF) for a feature $X_j$ is $\frac{1}{1-R_j^2}$, where $R_j^2$ is obtained by predicting $X_j$ from all features excluding $X_j$

- this measures the impact of multicollinearity on a feature coefficient

- Studying

- Variable Selection via Nonconcave Penalized Likelihood and Its Oracle Properties (fan & li, 2001) - frame an estimator as “oracle” if:

- it can correctly select the nonzero coefficients in a model with prob converging to one

- and if the nonzero coefficients are asymptotically normal

- AdaLasso: The Adaptive Lasso and Its Oracle Properties (zou, 2006)

- can make lasso ““oracle” in the sense above by weighting each coef in the optimization

- appropriate weight for each feature $X_j$ is simply $1/ \hat{\beta_j}$, where we attain $\beta_j$ from fitting OLS with no weights

- can make lasso ““oracle” in the sense above by weighting each coef in the optimization

- Variable Selection via Nonconcave Penalized Likelihood and Its Oracle Properties (fan & li, 2001) - frame an estimator as “oracle” if:

- using marginal regression

- A Comparison of the Lasso and Marginal Regression (genovese…yao, 2011)

- Revisiting Marginal Regression (genovese, jin, & wasserman, 2009)

- Exact Post Model Selection Inference for Marginal Screening (jason lee & taylor, 2014)

- SIS: Sure independence screening for ultrahigh dimensional feature space (fan & lv, 2008, 2k+ citations)

- 2 steps (sometimes iterate these)

- Feature selection - select marginal features with largest absolute coefs (pick some threshold)

- Fit Lasso on selected features

- Followups

- Sure independence screening in generalized linear models with NP-dimensionality (fan & song, 2010)

- Nonparametric independence screening in sparse ultra-high-dimensional additive models (fan, feng, & song, 2011)

- RAR: Regularization after retention in ultrahigh dimensional linear regression models (weng, feng, & qiao, 2017) - only apply regularization on features not identified to be marginally important

- Regularization After Marginal Learning for Ultra-High Dimensional Regression Models (feng & yu, 2017) - introduces 3-step procedure using a retention set, noise set, and undetermined set

- 2 steps (sometimes iterate these)

sums interpretation

- SST - total sum of squares - measure of total variation in response variable

- $\sum(y_i-\bar{y})^2$

- SSR - regression sum of squares - measure of variation explained by predictors

- $\sum(\hat{y_i}-\bar{y})^2$

- SSE - measure of variation not explained by predictors

- $\sum(y_i-\hat{y_i})^2$

- SST = SSR + SSE

- $R^2 = \frac{SSR}{SST}$ - coefficient of determination

- measures the proportion of variation in Y that is explained by the predictor

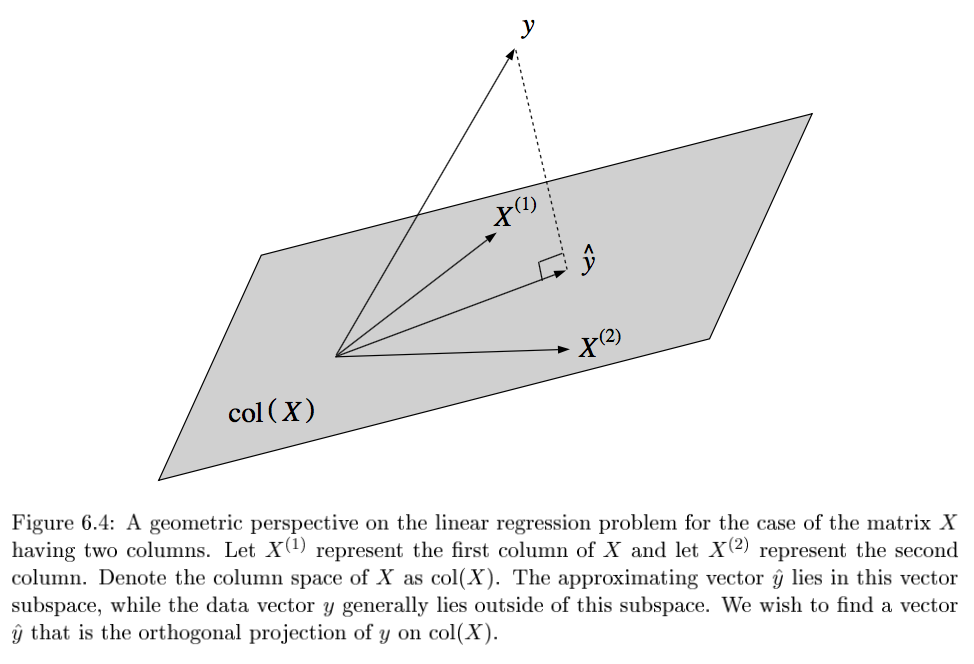

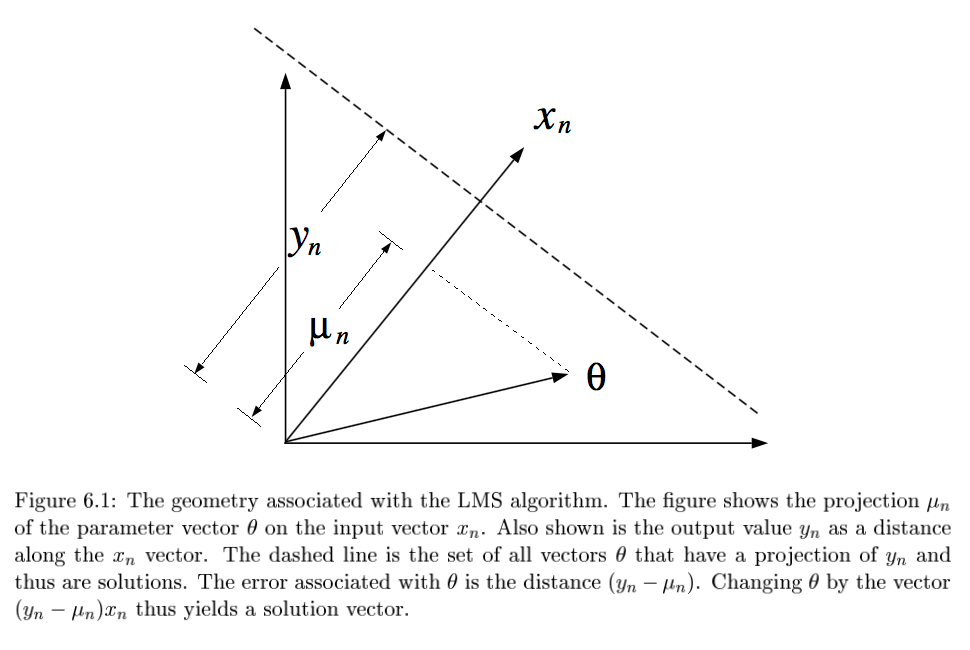

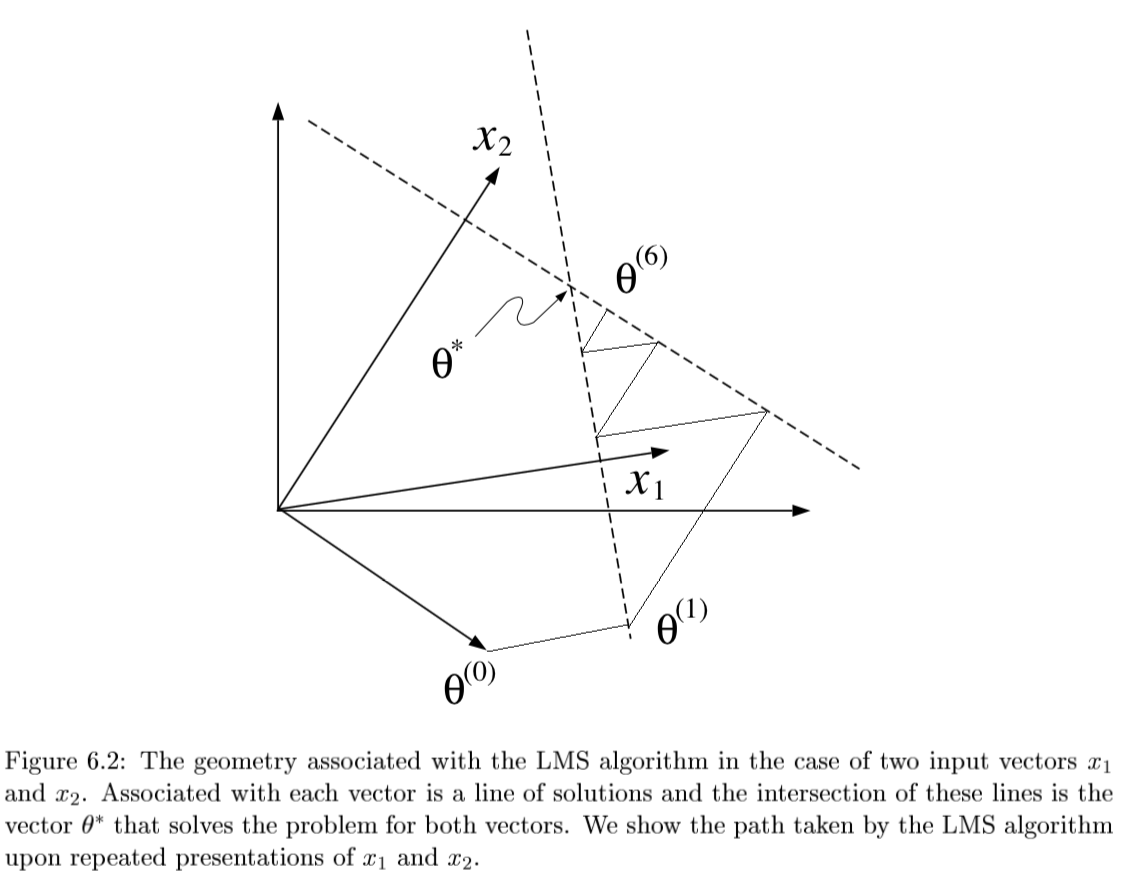

geometry - J. 6

-

LMS = least mean squares (p-dimensional geometries)

- $y_n = \theta^T x_n + \epsilon_n$

- $\theta^{(t+1)}=\theta^{(t)} + \alpha (y_n - \theta^{(t)T} x_n) x_n$

-

converges if $0 < \alpha < 2/ x_n ^2$

-

- if N=p and all $x^{(i)}$ are lin. indepedent, then there exists exact solution $\theta$

-

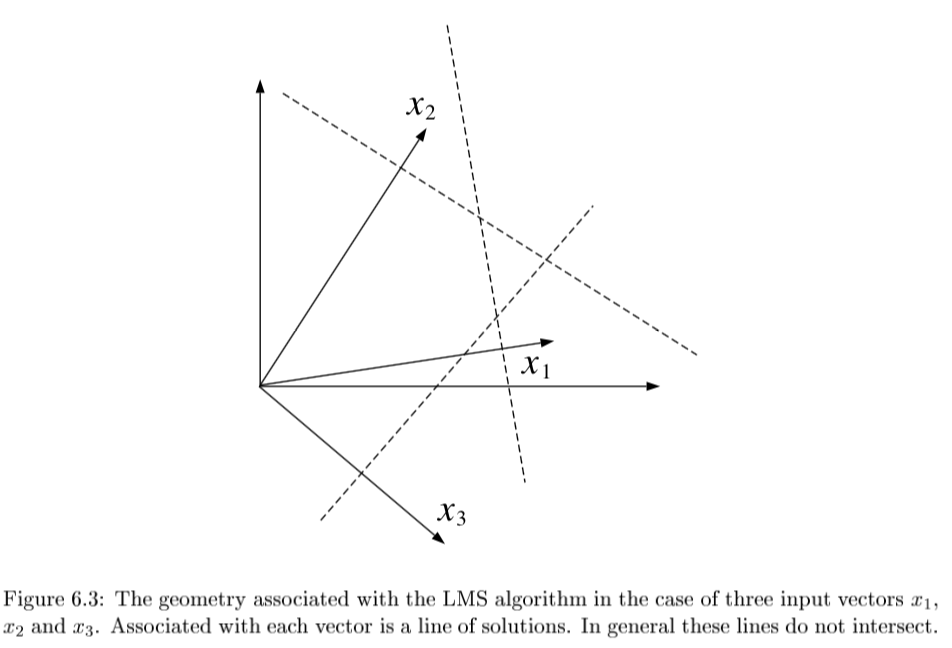

solving requires finding orthogonal projection of y on column space of X (n-dimensional geometries)

- 3 Pfs

- geometry - $y-X\theta^*$ must be orthogonal to columns of X: $X^T(y-X\theta)=0$

- minimize least square cost function and differentiate

- show HY projects Y onto col(X)

- either of these approaches yield the normal eqns: $X^TX \theta^* = X^Ty$

-

SGD

- SGD converges to normal eqn

-

convergence analysis: requires $0 < \rho < 2/\lambda_{max} [X^TX]$

- algebraic analysis: expand $\theta^{(t+1)}$ and take $t \to \infty$

- geometric convergence analysis: consider contours of loss function

-

weighted least squares: $J(\theta)=\frac{1}{2}\sum_n w_n (y_n - \theta^T x_n)^2$

- yields $X^T WX \theta^* = X^T Wy$

-

probabilistic interpretation

- $p(y|x, \theta) = \frac{1}{(2\pi\sigma^2)^{N/2}} exp \left( \frac{-1}{2\sigma^2} \sum_{n=1}^N (y_n - \theta^T x_n)^2 \right)$

- $l(\theta; x,y) = - \frac{1}{2\sigma^2} \sum_{n=1}^N (y_n - \theta^T x_n)^2$

- log-likelihood is equivalent to least-squares cost function

likelihood calcs

normal equation

- $L(\theta) = \frac{1}{2} \sum_{i=1}^n (\hat{y}_i-y_i)^2$

- $L(\theta) = 1/2 (X \theta - y)^T (X \theta -y)$

- $L(\theta) = 1/2 (\theta^T X^T - y^T) (X \theta -y)$

- $L(\theta) = 1/2 (\theta^T X^T X \theta - 2 \theta^T X^T y +y^T y)$

- $0=\frac{\partial L}{\partial \theta} = 2X^TX\theta - 2X^T y$

- $X^Ty=X^TX\theta$

- $\theta = (X^TX)^{-1} X^Ty$

ridge regression

- $L(\theta) = \sum_{i=1}^n (\hat{y}_i-y_i)^2+ \lambda \vert \vert \theta\vert \vert _2^2$

- $L(\theta) = (X \theta - y)^T (X \theta -y)+ \lambda \theta^T \theta$

- $L(\theta) = \theta^T X^T X \theta - 2 \theta^T X^T y +y^T y + \lambda \theta^T \theta$

- $0=\frac{\partial L}{\partial \theta} = 2X^TX\theta - 2X^T y+2\lambda \theta$

- $\theta = (X^TX+\lambda I)^{-1} X^T y$